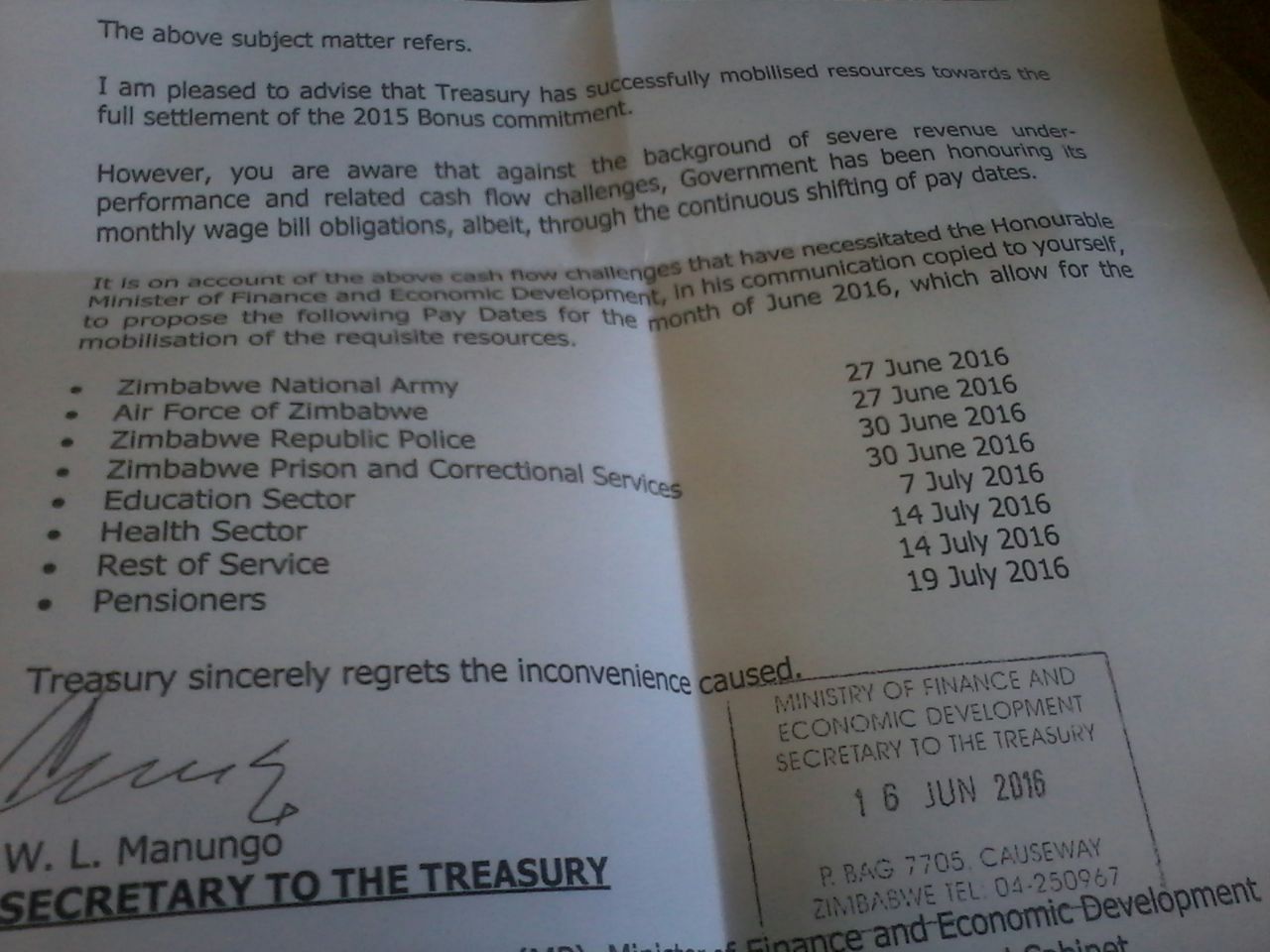

A letter (pictured) stamped 16 June 2016 seemingly signed by W.L. Manungo Secretary to the Treasury doing the rounds on social media and also published by an online publication((New Zimbabwe.com – Govt: No June pay for teachers, nurses – only army and police get salaries)) is the clearest sign yet why despite serious and numerous protests from business and the general public, government remains adamant concerning bond notes introduction now set for October 2016.

The letter, which carries the hallmarks of authenticity, speaks of a Treasury that is in deep trouble. It has happened before, albeit in the last view months, that government has failed to pay core civil servants their wages within the same month they are due as is tradition since 1980 when Zimbabwe got its independence.

This time around the scale is appalling and this may just be the beginning.

I couldn’t help but notice that the order in which the pay dates have been shifted gives insight into which sector of the civil service is most worrisome to government. It is the security sector made up of police, army and prisons. This is the only sector, according to the letter, whose pay dates have not spilled into a new month.

Of all the civil servants, pensioners, aged and frail to fend for themselves and posing the least threat to national security and stability are the last to expect settlement nearly one month later on the 19th of July 2016.

Many saw this coming. Treasury itself must have seen this coming. In the absence of any offsetting FDI or balance of payments support, treasury needed to create breathing space for itself and this could only happen through a “surrogate currency”, to borrow President Mugabe’s recent description of the bond notes in early June.((The Source – Mugabe on cash crisis: Cash crunch temporary, bond notes “surrogate currency”))

As to why Reserve Bank of Zimbabwe (RBZ) Governor Dr John Mangudya continues to give the public the impression that the bond notes are an export incentive and only meant for exporters is perplexing. He is on record saying the public will not even see the bond notes only perhaps sometime in 2017 because they “will be so scarce” as they are meant for exporters.((The NewsDay – Mangudya grilled over bond notes, SA rands))

If that is the case its hard to imagine how the liquidity crunch would possibly be tamed. If the bond notes “will be so scarce” then it means the export incentive would not have worked. If exporters respond to the incentive as hoped for by the RBZ, then we can expect a rapid emergence of the bond notes in ordinary transactions as exporters withdraw them to use locally. If an exporter exported US$20 million worth of exports and received the promised 5% export incentive, that would be US$1 million in bond notes!

What would the exporter do with it except pay employees and buy goods and services in the domestic economy since they can’t be used to import anything. If the Governor is expecting a scarcity of the notes then he is equally predicting doom of the incentive before it has even began. This defeats the purpose of its introduction in the first place at such a cost and damage to confidence in the overall economy.

I think this economy is in such deep katzenjammer first of all because of overall mishandling but also, and equally important, due to an entrenched lack of honesty even at the highest levels when and were honesty is needed the most.

The Governor would like business, investors and the public to believe the government which he serves will sit back watching pallets and piles of bond notes sitting in RBZ vaults waiting for exporters, which happen to be in short supply anyway, whilst treasury is failing to pay the civil service. The Retailers Association of Zimbabwe clearly thinks otherwise, telling a ZBC news reporter in a recent televised interview that its members are ready for the circulation of the bond notes.

It is true as suggested by President Mugabe that the bond notes are a stopgap currency which is another name for surrogate. They are coming in to attempt to stop the widening gap between falling revenue collections by government and ever present government expenses. One of those biggest expenses is the civil service wage bill, the subject of the letter, which has long been reported to gobble over 80% of total government collections.

So the primary objective of the bond notes from were I sit is to take care of government expenses first and foremost – something which has direct implications on political continuance of the governing party. Minister of Finance Patrick Chinamasa in May was reported to have indicated that there is no going back on bond notes.((The NewsDay – No going back on bond notes: Chinamasa))

This insistence on bond notes is what is both telling and deeply worrying even in the face of such resistance from the market. Since government is such a humongous spender, as already explained, its a reasonable assumption that the notes will inevitably and easily find their way into day to day mainstream transactions contrary to Dr Mangudya’s affirmation that they are a behind the scenes instrument.

If we are to believe that the notes will be rarely seen in circulation by the members of the public, as the Governor claims, then an alternative explanation is needed to settle the question of how an evidently cash hungry treasury will fund its day to day expenses because that is really the pressing issue for government at the moment.

Government is broke.

Short of some form of intervention, the likes of bond notes, government will not only keep shifting pay dates with a growing separation but will ultimately fail to pay government employees and to honor many of its other unavoidable obligations.

The bond notes themselves are what they are – stopgap – and cannot be a permanent solution. Their objective is to give relief to government as the biggest spender and as a by-product to improve liquidity for everyone else. It’s anyone’s guess how long that relief will last.

It’s apparent too much time, effort and energy has been spent and is being spent on a “surrogate currency” which is no where near the real solution. Exerting so much time and energy on a mucky $200 million facility as if it’s the all in all when monthly government commitments exceed that amount by far, further suggests sinister motives behind the bond notes. This is all happening in a context of reports that the bond notes measures announced by the Governor were not communicated to the IMF prior((The Source – OPINION: OFFICIAL VS CITIZEN ECONOMY IN ZIMBABWE – reading the crystal ball by looking into the rear view mirror)) despite the two having been in ongoing supposedly frank and transparent economic stability discussions.

I observe that few if at all, including the Governor himself, have tabled a real game changer to our current predicament. That game changer should go deeper than repeated calls for increased exports because that does not come by enchantment.

RBZ Govenor Image: voazimbabwe.com